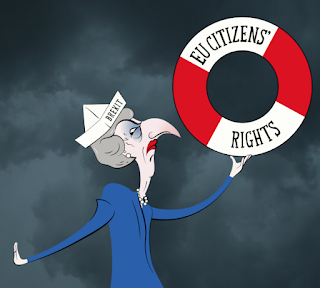

Registration system for EU citizens in the UK

The British government launched last Saturday a system created to register the stay of EU citizens living in the United Kingdom, The process is free, and the application is time at least until December 2020. To obtain the status of a settled status, you will need to prove that you have been in the United Kingdom for at least six months in each of these years in the last five years. Otherwise, the person submitting the application will receive a temporary pre-settled status, which can be changed after fulfilling the five-year requirement. If London agrees with Brussels regarding the conditions for leaving the Community, EU citizens will have until the end of June 2021 to register in the new system. In the case of hard Brexit, this time would be shortened until the end of December 2020. Initially, the registration in the system was 65 pounds (32.50 pounds for a child), but from Saturday, the earlier political announcement of Prime Minister Theresa May abo